Bankruptcy Court Monthly Operating Report MOR free printable template

Show details

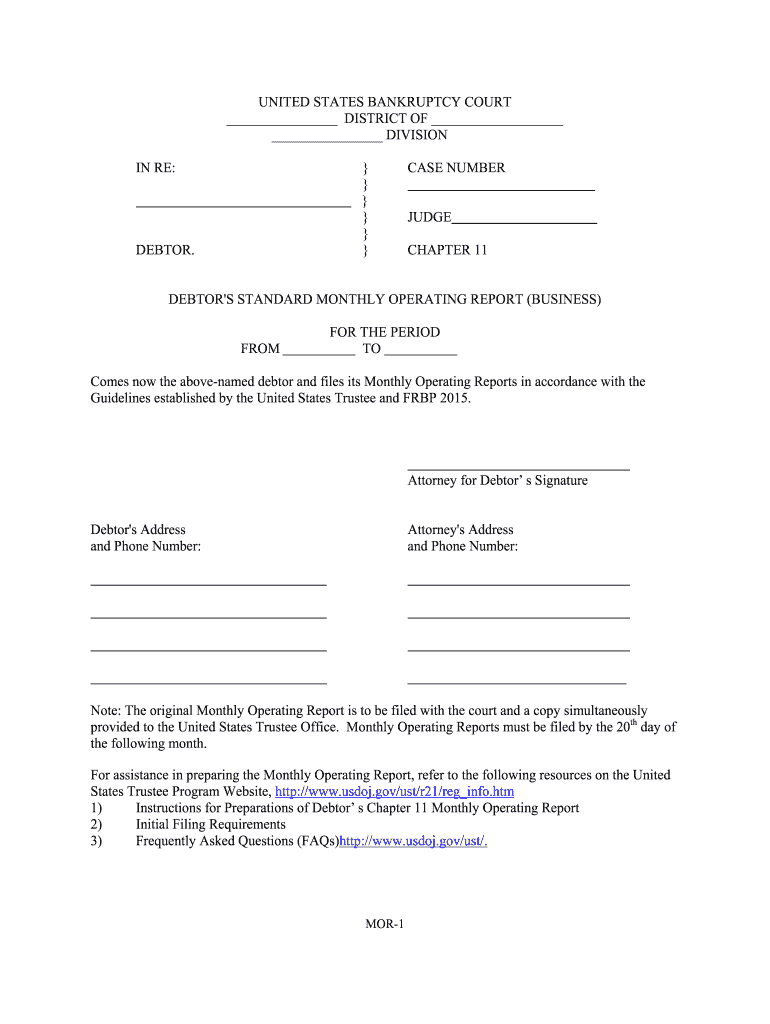

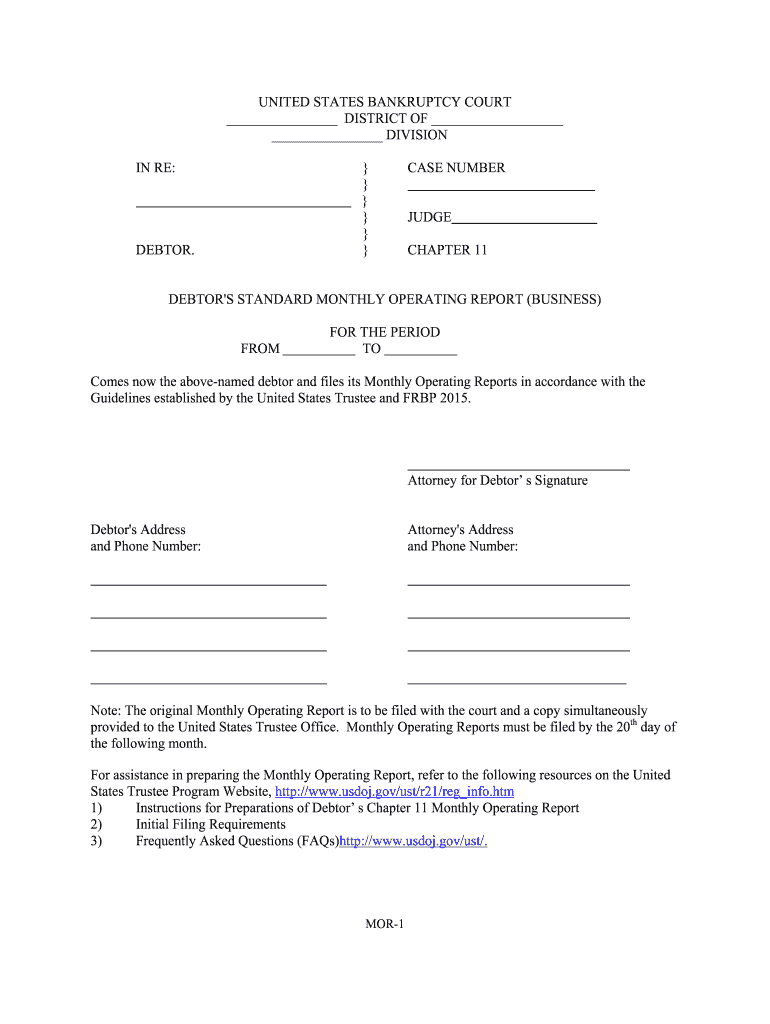

Monthly Operating Reports must be filed by the 20th day of the following month. For assistance in preparing the Monthly Operating Report refer to the following resources on the United States Trustee Program Website http //www. UNITED STATES BANKRUPTCY COURT DISTRICT OF IN RE DEBTOR. CASE NUMBER JUDGE CHAPTER 11 DEBTOR S STANDARD MONTHLY OPERATING REPORT BUSINESS FROM FOR THE PERIOD TO Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bankruptcy mor services form

Edit your us monthly operating report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your service for monthly operating reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mor report online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mor form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mor 00 case report form

How to fill out Bankruptcy Court Monthly Operating Report (MOR)

01

Gather financial documents: Collect all relevant financial statements, including income statements, balance sheets, and cash flow statements.

02

Review the requirements: Familiarize yourself with the specific requirements set by the bankruptcy court for the Monthly Operating Report.

03

Fill in income section: Report all sources of income received during the reporting period.

04

Document expenses: Carefully list all expenses incurred during the same period, categorizing them appropriately.

05

Update asset and liability information: Provide current details on assets and liabilities, including any changes since the last report.

06

Complete cash flow analysis: Outline cash inflows and outflows to show the financial health and liquidity of the business.

07

Sign and date the report: Ensure that the report is signed by the authorized individual and dated accurately.

08

Submit the report: Send the completed Monthly Operating Report to the bankruptcy court by the required deadline.

Who needs Bankruptcy Court Monthly Operating Report (MOR)?

01

Debtors: Individuals or businesses undergoing bankruptcy proceedings need to file MORs to comply with court requirements.

02

Creditors: Creditors may review the MOR to monitor the financial status of the debtor and ensure transparency.

03

Bankruptcy trustees: Trustees use the MOR to assess the debtor's financial condition and manage the bankruptcy process.

04

Legal representatives: Attorneys representing the debtor or creditors need access to the MOR for case management.

Fill

monthly operating report template

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit monthly operating report online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mor forms and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit mor reporting in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing mor monthly operating report and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out chapter 11 monthly operating report on an Android device?

Use the pdfFiller mobile app to complete your mor report finance on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is Bankruptcy Court Monthly Operating Report (MOR)?

The Bankruptcy Court Monthly Operating Report (MOR) is a financial document that provides an overview of a debtor's financial situation, including income, expenses, cash flow, and other key financial metrics during the bankruptcy process.

Who is required to file Bankruptcy Court Monthly Operating Report (MOR)?

Debtors who have filed for bankruptcy and are operating under Chapter 11 are required to file the Bankruptcy Court Monthly Operating Report (MOR) to keep the court and creditors informed about their financial status.

How to fill out Bankruptcy Court Monthly Operating Report (MOR)?

To fill out the Bankruptcy Court Monthly Operating Report (MOR), debtors must provide accurate and detailed financial information, including revenue, operating expenses, payables, receivables, and any significant changes in their financial condition.

What is the purpose of Bankruptcy Court Monthly Operating Report (MOR)?

The purpose of the Bankruptcy Court Monthly Operating Report (MOR) is to ensure transparency and accountability in the bankruptcy process, allowing the court and stakeholders to monitor the debtor's financial performance and progress towards reorganization.

What information must be reported on Bankruptcy Court Monthly Operating Report (MOR)?

The Bankruptcy Court Monthly Operating Report (MOR) must include information such as income and operating revenue, expenses, cash disbursements, receipts, accounts payable and receivable, and any other relevant financial disclosures as required by the court.

Fill out your Bankruptcy Court Monthly Operating Report MOR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mor Monthly Operating Review is not the form you're looking for?Search for another form here.

Keywords relevant to american signature chapter 11 filing

Related to mor reports

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.